Some say Scala’s past its prime. That it lost to Kotlin. That Python dominates the big data domain, and Go took the backend.

And yet—look what stands behind high-performance data platforms, financial systems, and distributed apps. Scala’s still right there.

But the truth is.

In 2025, Scala isn’t trying to win a popularity contest. It’s doubling down on what it does best: speed, safety, and scalability. That’s why it remains a key player in backend engineering and big data processing.

This article takes a look at where Scala stands today:

- How the Scala job market has evolved over the years

- Why companies continue choosing Scala for core infrastructure

- Where the talent is

- How Scala stacks up in 2025

Let’s dive in.

Scala Market Share Dynamics: Is Scala in Demand?

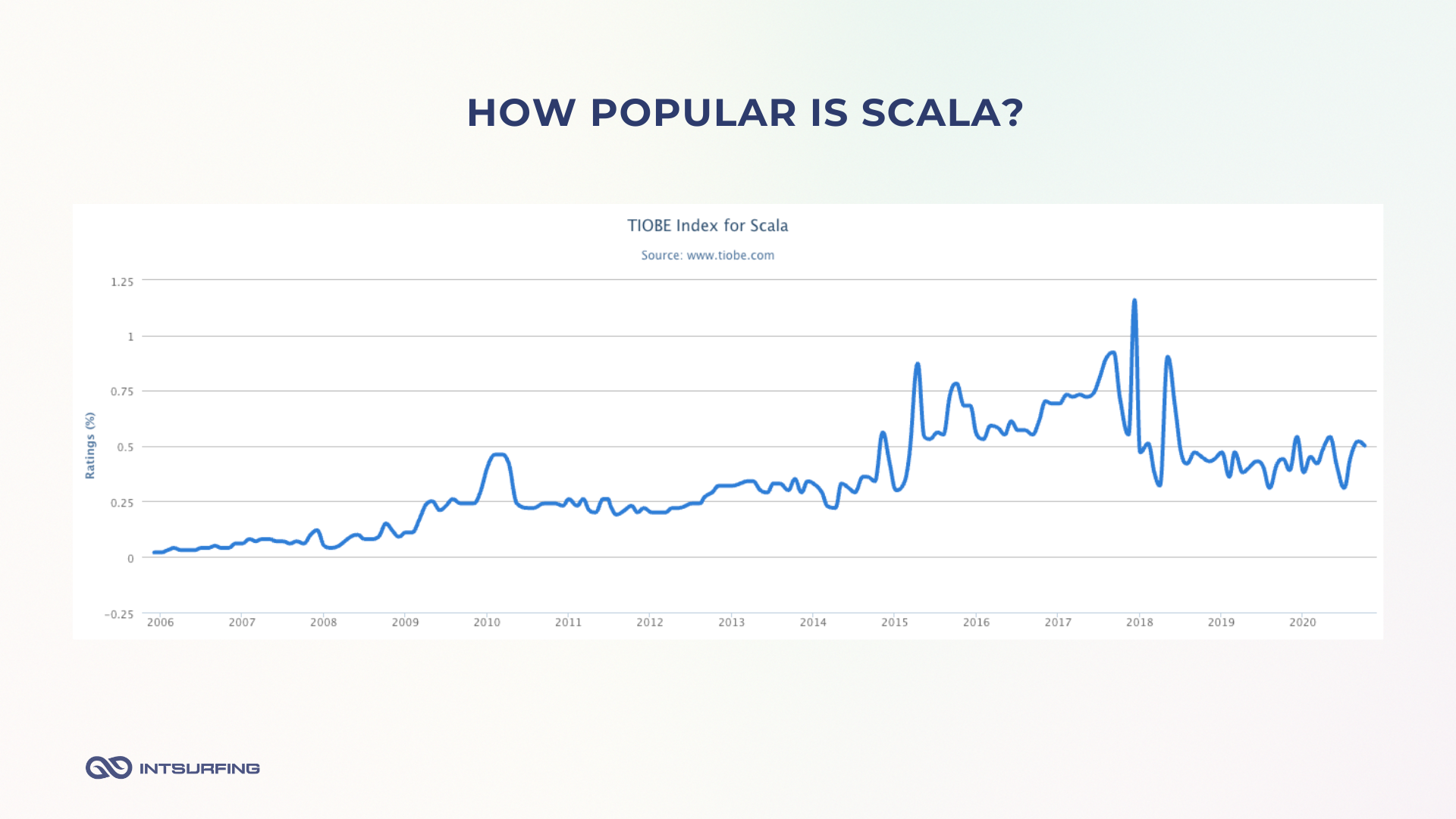

As of 2025, Scala sits at #27 on the TIOBE Index with a 0.67% rating. Not exactly Java-level dominance—but that’s never been the point. Scala was never built to be mainstream. It was built to be powerful.

Back in 2010, Scala had its first big moment. Then between 2015 and 2018, it really took off.

What happened? A few things.

- Apache Spark exploded in popularity. And since Scala is Spark’s native language, data engineers flocked to it.

- Big players (Twitter, Netflix, and LinkedIn) started using Scala to build backend systems.

- In fintech, Scala became a natural choice.

- There was the release of Scala 2.11 and 2.12—faster, sleeker, and finally Java 8 compatible.

- Frameworks (Akka and Play) gave developers the tools to build reactive, distributed systems.

- The rise of functional programming—Scala fit right in, offering a hybrid of functional and object-oriented styles that felt modern and powerful.

By that point, Scala was lucrative. Scala devs were topping salary charts, and companies were scrambling to hire.

However, post-2018, Kotlin, Go, and Rust started getting more attention. Python kept eating up everything in data science.

Despite that, Scala matured. Its third version was launched in May 2021. It focused on making life easier for developers. Cleaner syntax. Stronger type inference. Simplified implicits (now called “givens”). Union types. Enums. The language got better. More readable, more approachable, and easier to maintain.

Did it lead to a massive adoption spike?

No.

But it gave Scala a stronger foundation and helped teams stick with it—or finally take the leap.

Demand for Scala Developers & Market Health in 2025

In 2025, the Scala job market is a niche thing. It doesn’t come close to the volume of listings you’ll see for Java, Python, or JavaScript—but in the right industries, it’s holding strong.

Globally, demand for Scala has leveled off, and in some regions, even dipped a bit. Back in 2021–2022, developer surveys and trend trackers showed Scala’s usage share slipping. That shift showed up in hiring data, too.

Take the UK: job postings for Scala roles in late 2024 were noticeably down from 2021 levels. Part of that’s due to a broader tech hiring slowdown, and part of it’s Kotlin and other JVM contenders picking up steam.

But here’s the key: the demand didn’t disappear—it just narrowed.

You’re not going to find tons of entry-level roles or general-purpose web dev jobs looking for Scala skills. That era’s gone. What you will find is strong, consistent hiring in data engineering and senior backend roles. The companies using Scala today? They’ve been using it for years. Their codebases are complex, their systems critical, and they need people who know how to work at scale.

On Reddit and other dev communities, Scala’s job market is described as “not as big—but stable.” And that tracks. Apache Spark and Flink still lean heavily on Scala. And in finance and tech, companies with mature Scala stacks are still investing in talent to support and evolve those platforms.

Top Industries Hiring Scala Developers

Scala is meant for solving big, complex problems. That’s why you’ll find it powering some of the most demanding industries out there. Let’s break down where that demand is coming from in 2025.

FinTech and Finance

According to Xebia, demand for Scala in the financial sector “has absolutely exploded” and Scala became the preferred choice for many cloud-based financial platforms.

Large investment banks and hedge funds adopted Scala for their trading platforms, risk analytics, and data infrastructure. J.P. Morgan, Citi, Morgan Stanley, Barclays, and others have sizeable Scala teams.

FinTech startups (digital banks, payment companies, crypto trading platforms) also use Scala to build reliable, high-throughput systems.

Scala’s strong showing in finance is due to its Java interoperability (easy to integrate with legacy systems) and its ability to express complex logic (useful for financial algorithms) with fewer bugs.

Big Data & Analytics Companies

If your product is data, there’s a good chance your backend is running Scala. Apple, LinkedIn, Netflix, and Twitter all rely on Scala somewhere in their tech stack.

Why Scala for big data? Because it was built for this. It plays incredibly well with Apache Spark, Kafka, and Flink. If your platform needs to analyze billions of records or stream data in real time, Scala is still one of the best tools for the job.

You’ll also find demand coming from analytics consultancies, SaaS platforms, and companies in ad-tech, e-commerce, and social media. Any place where data volume meets real-time urgency—Scala is likely under the hood.

So, it’s no wonder around 55% of Scala engineers use this programming language for data processing.

Web Tech and Cloud Infrastructure

Although Scala is less dominant in mainstream web development than JavaScript or Python, certain web companies use Scala for their backends.

For instance, Twitter rebuilt parts of its backend in Scala years ago. Zalando and The Guardian have also turned to Scala to power their backend services.

On the infrastructure side, Scala is embedded in Apache Kafka, Flink, and Akka Serverless. So, the companies building and running those tools need Scala talent. The same goes for platforms offering cloud-native services based on these frameworks.

Even the gaming industry dips into Scala territory. For high-concurrency backend systems—like those managing massive multiplayer sessions or real-time game events—Scala combined with Akka can deliver the speed and reliability that Unity or Unreal just aren’t built for.

How Many Scala Developers Are There?

According to the 2024 Stack Overflow Developer Survey, just 2.6% of developers said they did extensive work with Scala in the past year. That might sound small—but when you apply that to a global developer population of around 19.6 million, you’re still looking at more than 500,000 active Scala developers worldwide.

So why isn’t that number bigger?

It comes down to a few factors:

- Scala’s steep learning curve. Scala isn’t exactly beginner-friendly. Its mix of functional and object-oriented paradigms, complex syntax (especially in Scala 2), and advanced type system makes it a language that takes time to master. This naturally limits how fast new developers enter the space.

- It’s big in niche industries. You won’t find Scala powering your average startup landing page. It’s built for high-throughput data systems, distributed computing, and backend infrastructure in finance, telecom, and data-heavy enterprise apps. That focus keeps demand strong—but concentrated.

- The Scala 2 to Scala 3 shift. The release of Scala 3 brought a lot of improvements—simplified syntax, better type inference, new language features—but it also slowed down hiring for a while. Some teams waited to adopt until tooling matured. Others stuck with Scala 2 while evaluating the cost of retraining. As a result, Scala 3 has helped long-term adoption, but created short-term friction in onboarding and team growth.

Bottom line: Scala’s developer base isn’t huge, but it’s experienced and highly specialized. If you’re working in the kind of environment where Scala shines, that 500k+ pool is packed with exactly the kind of talent you want.

But more on this in the next section.

Who Becomes a Scala Engineer: Scala Developer Demographics & Background

Scala tends to attract experienced engineers with strong technical backgrounds—and the data backs that up.

Typical Background

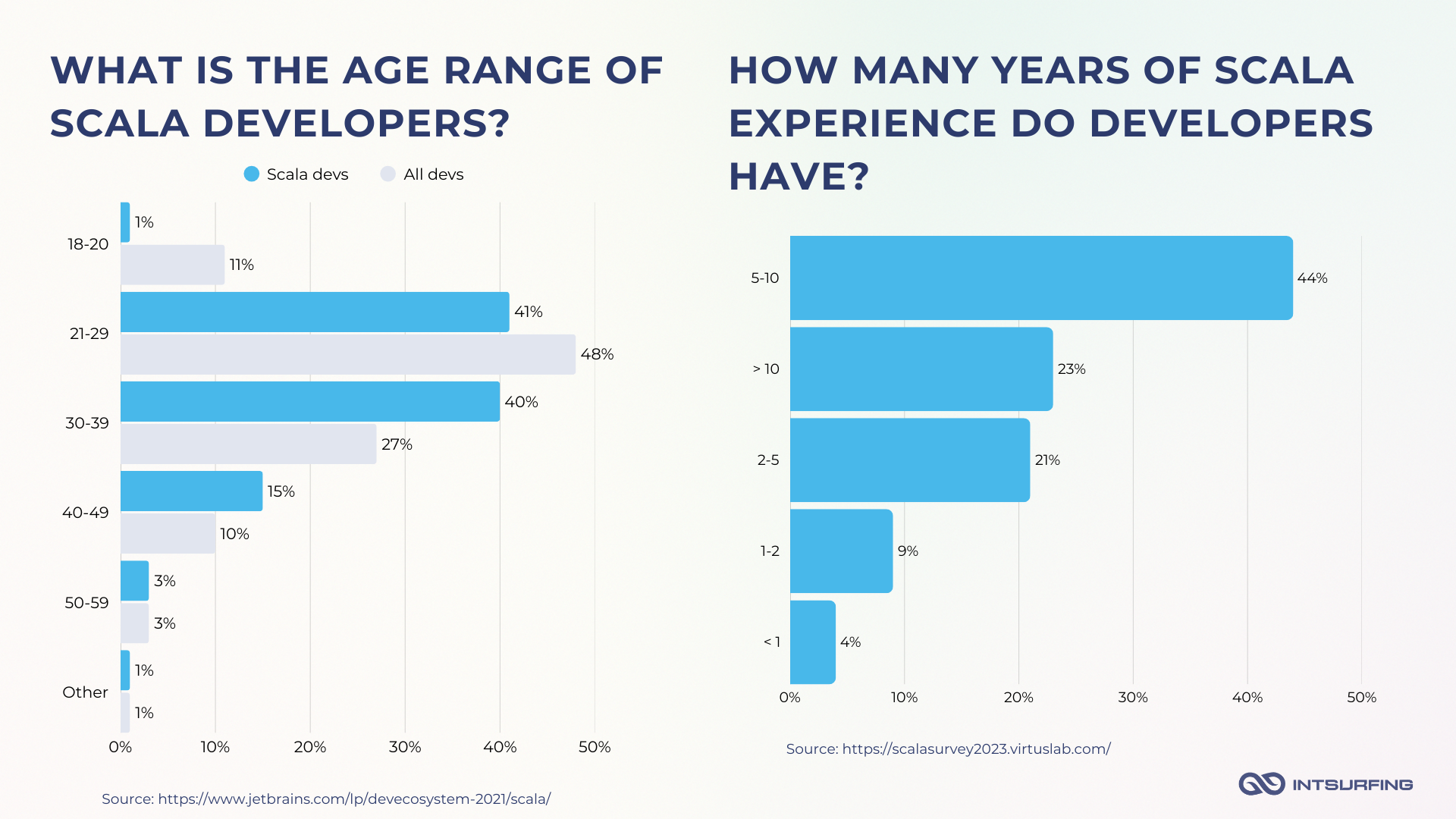

According to JetBrains, Scala programmers are on average older and more experienced than the typical developer.

Nearly 67% of Scala developers have over 5 years of hands-on experience with the language. The number of newcomers is tiny by comparison, with just 4% having less than a year of experience.

When it comes to age, only 41% fall into the 21–29 age group, compared to nearly half of all devs in that range. Meanwhile, a solid 40% are in their 30s, and 15% are 40–49. This tracks with the experience and education levels: Scala tends to attract seasoned engineers.

Other Languages Scala Devs Know

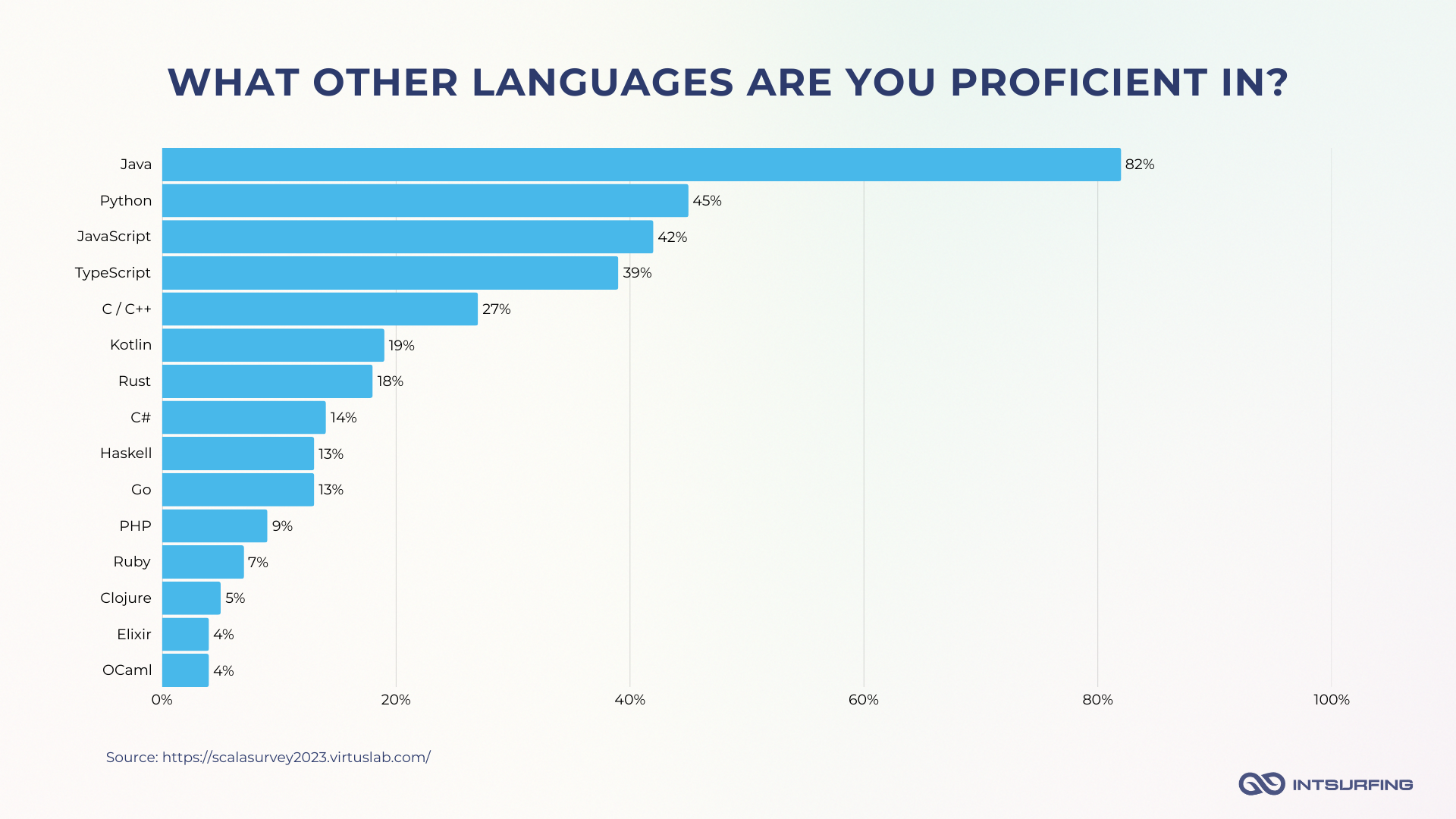

Scala engineers often have broad backend or infrastructure experience. Many transitioned to Scala after mastering other languages. 82% also know Java, which makes sense given Scala’s JVM roots. But you’ll also find a lot of overlap with Python (45%), JavaScript (42%), and TypeScript (39%). Many Scala devs bring experience from functional or systems-level languages—Rust, Haskell, or C++.

Education and Learning Methods

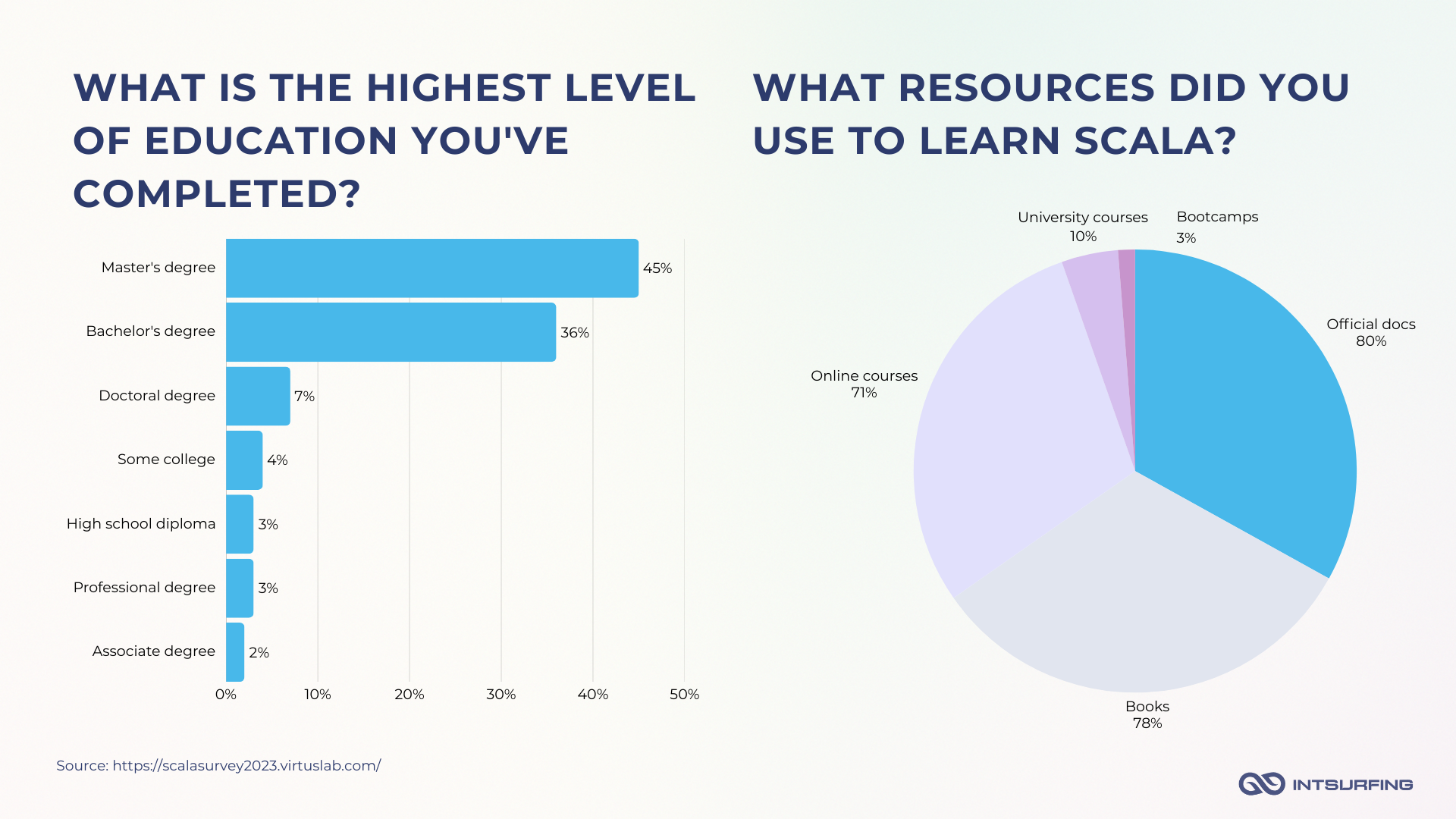

Scala’s complexity and use in advanced domains tends to attract highly educated developers.

A large share have at least a Bachelor’s or Master’s in computer science or related fields (for example, about 66% of developers globally have a BA/BS or higher). But it doesn’t mean they mastered this language in universities.

How do Scala devs learn then? Mostly on their own. 80% use official docs, 78% turn to books, and 71% take online courses. Only 10% learned Scala through university courses, and bootcamps barely register at all.

Work Environments

According to the Stack Overflow survey, 69% of developers (all languages) are full-time employed, while about 15% are independent contractors or freelancers. Scala’s market reflects this general split – most are full-time engineers (in roles of engineers, architects, data analysts, and so on), but a notable minority consult or freelance, leveraging their specialized skills.

In Eastern Europe, many Scala devs engage in outsourcing/contract work for foreign clients (either directly as freelancers or via consultancies). For instance, countries with strong IT export markets (Ukraine, Poland, etc.) often have a higher proportion of self-employed or contract developers, as they can earn more via overseas projects.

Geographic Distribution

The global Scala community is spread across North America, Europe, and parts of Asia and Latin America.

- North America & Western Europe. The United States has long been a Scala stronghold. That demand seeded deep local talent, especially in tech hubs (Silicon Valley) and finance centers (New York). Across the Atlantic, the UK, Germany, France, and the Netherlands also built solid Scala communities. London in particular emerged early as a Scala hub, driven by financial services and startups working with Spark and Akka.

- Central/Eastern Europe (CEE). Poland, Ukraine, and Romania have become serious players in the Scala space. Poland is home to over 3,500 Scala developers, and Ukraine ranks #8 globally by Scala developer count. Ukrainian engineers have embraced Scala particularly in outsourcing and product development companies.

- Asia & Latin America. In India and China, Scala adoption is more niche. You’ll find it inside large tech firms or as part of big data initiatives—but it’s still a small slice of the overall dev pie. In Latin America, Brazil, Mexico, and Argentina are growing Scala communities fast, often tied to remote roles supporting US and EU companies.

How Much Do Scala Developers Make?

Scala developers are among the best-paid software engineers, thanks to the language’s use in high-value domains and the relative scarcity of experienced Scala talent.

Let’s look at the numbers.

According to Stack Overflow’s latest data, Scala developers report a median annual salary of $89,099, putting them near the top of the chart. That’s more than JavaScript, Python, Java, and C#. It’s on par with or higher than niche backend and functional languages: Elixir, Clojure, and Ruby.

JetBrains backs this up with another angle. Scala leads all languages in the percentage of developers who fall into the top salary quartile in their region—37% of Scala developers are top-paid, ahead of Go (35%), Kotlin (34%), and even low-level languages like C++ and C.

Of course, not every Scala developer earns six figures. Salary depends heavily on two things: where you’re based and how experienced you are.

Salaries of Scala Engineers Based on Region

United States offer the highest salaries for Scala engineers. Average Scala developer salaries are in the low-to-mid six figures. Even the median U.S. Scala developer earns around $170k base by Glassdoor estimates. Niche expertise (e.g. Scala + big data) pushes this higher.

In Western Europe, salaries are high, though generally 20–40% lower than U.S. levels. In the UK, for example, a mid-level Scala dev earns £70k–£80k. In Germany, average Scala developer pay is about €66k ($70k). Switzerland and the Nordics can exceed these (Zurich or Oslo-based Scala engineers might rival U.S. salaries due to high cost of living).

Southern Europe (Italy, Spain) tends to be lower, often in the €40–60k range for experienced Scala devs.

Salaries are significantly lower in absolute terms but competitive relative to local costs in Eastern Europe (Ukraine, Poland, etc.). In Ukraine, a strong senior Scala developer can net around $60k–$70k yearly, which places them at the top of the local pay scale. Poland’s Scala dev salaries might be slightly lower on average (e.g. a senior maybe ~$50k). These lower costs are a major reason companies outsource Scala projects to Eastern Europe. The talent quality is high, and a Western company can hire two or more Eastern European Scala engineers for the cost of one U.S.-based engineer.

In Asia and Latin America, salaries vary widely. In India, for instance, a Scala developer might earn ₹15–20 lakhs per year ($20k–$25k) as a senior, which is above average for software roles there but still far below Western pay. In China, domestic Scala roles aren’t common, but multinational companies might pay Scala devs the equivalent of $30k–$50k. Latin American Scala developers (in Brazil, Argentina, etc.) might see salaries in the $30k–$60k range if working for U.S. companies remotely.

Salaries of Scala Programmers by Experience Level

In Scala, experience pays—literally. Because the language is often used in high-stakes systems, companies want engineers who’ve been around, know the tools, and can navigate complex infrastructure.

That shows up in the salary data: the more years you’ve got under your belt, the more you make.

Glassdoor estimates Junior Scala dev base salaries around $110k in the US. In Western Europe, junior Scala roles might range roughly €40k–€60k (for example, ~€50k in Germany). In Ukraine, junior developers (rare in Scala, as the talent skew is senior) have more modest pay – often around $800–$1500 per month early on (roughly $10k–$18k/year), in line with other juniors in the region.

Mid-career Scala engineers in the U.S. average about $140k–$150k annually. Many mid-level Scala devs handle critical architecture tasks and thus command six-figure salaries. In Europe, mid-level Scala salaries are often in the $70k–$100k range (e.g., €66k average in Germany). In Ukraine or Eastern Europe, a mid-level Scala developer might earn on the order of $2.5k–$4k per month ( ~$30k–$50k/year), depending on the company and whether they work for a global firm or local one.

Senior Scala developers are highly sought-after and paid accordingly. In the U.S., senior Scala engineers often make $150k+ per year in base salary, with total compensation (including bonuses or equity) that can reach well into the $180k–200k range at top firms. Europe sees senior Scala salaries typically between €80k–€100k (for example, a UK Scala developer median was ~£80k in previous years, though recently around £70k). In Ukraine, senior Scala developers command premium rates for the region – monthly salaries around $4k–$6k are common for senior engineers, which is $50k–$72k per year (net). In fact, Scala is at the top end of the pay scale in the Ukrainian IT market: the median salary for developers working with Scala is about $5,500 per month (net), the highest among all languages.

Tech leads or architects with Scala expertise in Ukraine can earn $7k–8k+ per month ($85k–100k/year) for leading projects. Such figures, while lower than Silicon Valley standards, are very competitive given the cost of living, and make Ukrainian Scala specialists very cost-effective for companies hiring globally.

Scala vs. The World: How It Stacks Up in 2025

Scala is surrounded by newer, flashier, and often simpler languages that all want a piece of the same pie. So how does Scala hold its ground?

On the JVM, Kotlin is the biggest rival. It’s got cleaner syntax, strong tooling (thanks to JetBrains), and Google’s full backing in the Android world. For general-purpose app development, Kotlin is eating up market share—and Scala isn’t trying to stop it. Instead, Scala leans into its strengths. Kotlin isn’t built for heavy functional programming or complex data pipelines. Scala is. It’s still the go-to for power users building big systems.

Go and Rust are contenders in the high-performance server arena. Ten years ago, those projects may have used Scala + Akka. Today, some pick Go for its simplicity or Rust for its blazing speed and memory safety. Scala’s answer is to highlight its mature ecosystem (Akka, Spark) and the safety of the JVM. Over time, we might see some loss of new projects to these languages, but Scala will continue to evolve (e.g., Loom on the JVM (virtual threads) could boost Java/Scala performance for concurrency without needing Go-like coroutine systems).

Python remains a friendly rival in data science. Scala’s strategy isn’t to replace Python in notebooks, but to complement it – for example, using Scala for the heavy lifting and Python for the prototyping. Apache Zeppelin allow using Scala and Python in tandem. The future likely holds a polyglot data environment rather than winner-takes-all.

When it comes to functional programming, Scala still wears the industry crown. Haskell is brilliant but academic. Clojure is expressive but has a smaller community. F# has its fans in the .NET world but never hit critical mass. Scala makes functional programming practical in enterprise environments. And with Scala 3 borrowing ideas from Haskell, the language keeps evolving—bringing hardcore FP concepts to everyday engineering problems.

So, Is There Demand for Scala Programmers?

Let’s be real: Scala’s not about to explode in popularity. It’s not the next big thing. But it’s not going anywhere, either.

Scala has already found its lane—in big data, finance, backend infrastructure, and other many places. It’s not trying to win the hearts of every web dev or take over scripting roles.

But if you’re building the kind of system where throughput, type safety, and concurrency aren’t optional, you’ll want Scala in your corner. You’ll also want to know where to find the people who know how to use it.

Spoiler: they’re out there—and some of the best are in Ukraine.